July 2025 Edition

Welcome to the July edition of Cyrus Ventures Radar. This month marks a pivotal moment as we welcome Volund Manufacturing to our portfolio—a company solving the defense industry’s most critical challenge: mass production. While Anduril and peers are developing cutting-edge systems, Volund enables their scale, starting with significant cost reductions in turbine manufacturing. Our existing portfolio continues its momentum with Icarus preparing for August Army demonstrations and Arbor Energy entering into new advanced investor and contract conversations with energy industry goliaths. The broader market continues to validate our thesis as defense tech companies raised $3.3B in recent weeks while the Pentagon committed $200B to new initiatives.

Portfolio Spotlight

Cyrus is proud to support innovative companies in defense tech and energy:

-

Volund Manufacturing: Our newest portfolio company addresses what I believe is one of the defense sector’s greatest vulnerabilities: manufacturing capability. Volund is achieving orders of magnitude reductions in turbine production through proprietary automation developed by founders with experience from Apple and Anduril. As the DoD shifts from exquisite systems to mass-produced attritable platforms, Volund’s technology becomes mission-critical.

Meeting with Volund co-founders Ken Spaulding (L) and Eric Hostetler (M) at their new facility

-

Arbor Energy: Negotiations are progressing nicely on their hyperscaler contract, and now several large new players have begun to approach Arbor with interest in their gas turbine technology. With 5-7 year backlogs from incumbents, major energy companies have begun indicating strong interest in Arbor’s turbine technology. The company remains on track for a transformative announcement by year end.

-

Icarus: Momentum accelerates as Icarus prepares for their August Army demonstration following successful SOCOM presentations. The company secured a 12-month pilot contract with SOCOM and is continuously testing their vehicle in the stratosphere as they can now achieve 48-hour continuous flights. The work they’re doing is opening up countless possibilities for both the defense and commercial connectivity sectors.

Icarus team testing their stratospheric vehicle via balloon launch

Investment Opportunities & Updates

I’m working to secure allocations in several high-profile opportunities and wanted to provide some key updates from recent investments:

Emerging Opportunities : I’m actively pursuing allocations in OpenAI, Anthropic, and Apptronik for interested investors. In regards to OpenAI we are making strong inroads into opportunities that would allow us to avoid potential issues relating to the Microsoft antitrust lawsuit and dilution risk. If you have interest in any of those companies please reach out and I can give you the latest information on allocation availability.

Recent Investment Traction:

-

Chaos Inc.: We just closed an SPV for a portion of their Series C round. The $275M round was led by Accel and NEA, accelerating their transition from prototype to scaled production of their revolutionary sensing and counter-drone systems.

-

Anduril Industries: The company secured a $100M Army contract for Next-Gen Command & Control systems this month. They further benefitted from new legislation granting them an effective monopoly of $6B+ in border surveillance technology.

-

Impulse Space: Their LEO Express-2 mission continues successful payload deployments as they prepare for 2027 Helios missions transporting 4-ton satellites to GEO in under 8 hours. .

-

Stoke Space: Major progress at Cape Canaveral’s Launch Complex 14 with July flyovers revealing completed supported structures, tower construction, and flame trench preparation. The company’s aggressive hiring (48 open positions) signals imminent East Coast operations as they target orbital flights in the coming 12 months.

Anduril’s successful flight test of their 100M Barracuda missile

Team & Strategy

Our advisory team proved instrumental in validating Volund’s technology and market opportunity. With their manufacturing expertise and DoD experience the Cyrus team was able to both validate Volund’s cost reduction capabilities, as well as confirm the acute need for production capacity. This is one of the many ways that the Cyrus team is able to leverage decades of collective experience to identify and validate breakthrough opportunities before broader market recognition.

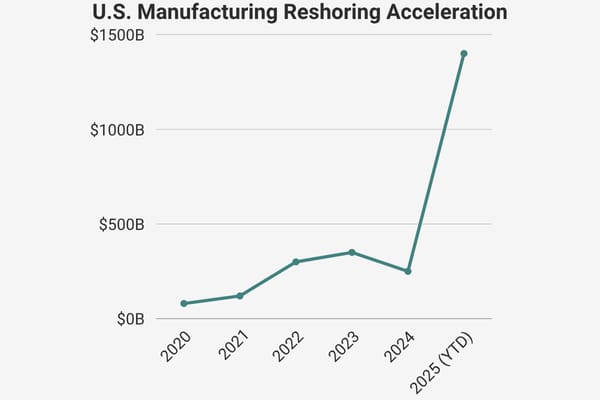

I recently attended the Reindustrialize Detroit conference, where industry leaders gathered to discuss the convergence of defense, manufacturing, and technology. At the conference Ambassador Greer announced a $1.4T in reshoring commitments since the election, adding to the momentum in American industrial policy. The bulk of conversation was highlighting how companies addressing manufacturing bottlenecks (like Volund) will capture outsized value as America rebuilds its industrial base. Palmer Luckey’s interview conducted through a Foundation robot, was just a small glimpse into the enormous ongoing development happening in these sectors.

Palmer Luckey (Anduril Co-Founder) being interviewed through a robot

Market Insights

Here are notable developments from recent months across defense and energy:

-

Golden Dome Secures Additional $13B: Congress approved another $13B for the missile defense initiative in July, bringing total funding up to $175B. This program’s open architecture creates opportunities for multiple vendors rather than single-source contracts. Impulse Space and Chaos Inc. are actively pursuing contracts for various capacities of sensors.

-

Defense Manufacturing Crisis Deepens: The Pentagon halted Patriot missile shipments to allies due to critically low U.S. stockpiles. Currently 155mm shell production reached 40,000 monthly versus the 100,000 target. This gap further proves out the necessity of companies like Volund.

U.S. Manufacturing Investment Commitments Surge Following CHIPS Act & IRA

-

AI Data Center Demand Overwhelms Grid: Data centers are now projected to consume up to 12% of U.S. electricity by 2028, driving Meta to sign a 1.1GW nuclear deal. Natural gas turbine manufacturers are reporting 5 year + backlogs with prices tripling. This energy crunch has driven significant traction to Arbor and their power production capabilities.

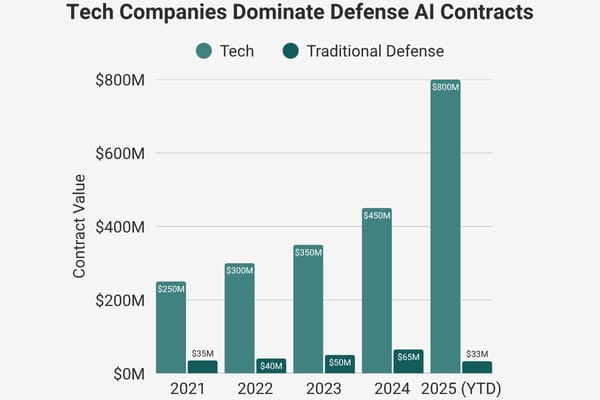

24:1 Ratio of Tech Companies’ AI Contracts vs Traditional Defense in 2025

Until Next Time

What is happening right now in the U.S. market is why I named this fund after Cyrus the Great, as we’re participating in the construction of a new American empire, this time built on manufacturing and autonomous systems rather than ancient armies. Our fund structure allows us to move quickly and decisively when we’re bullish and bring in numerous capital and industry partners help aid in portfolio company growth.

If you’re planning to visit Los Angeles in the coming weeks and would like to discuss our strategy and emerging opportunities, please reach out. As always, I believe successful investments grow from relationships built on trust, and there’s no substitute for meeting face-to-face.

Regards,

Jordan Yashari

Founder & General Partner

Cyrus Ventures

American Manufacturing Renaissance: The New Industrial Empire